General Risk

Mitigating Transaction Risks

Although the ways in which a platform can mitigate risk will vary based on the services being offered and what makes sense for their business model, there are still general steps all platforms can take to reduce their exposure.

KYC

In most cases collecting adequate KYC documentation makes it more difficult for fraudsters to use accounts they have taken over, or to create an account under a false or stolen identity. Furthermore, collecting helps avoid facilitating transactions on behalf of sanctioned individuals/entities and/or wanted criminals, and assists in the prevention of moving illicitly obtained funds. We must collect KYC in order to comply with US financial regulations, including the Bank Secrecy Act. Learn more in our KYC and User Overview page.

Synapse will set forth minimum CIP (Customer Identification Program) requirements in each platform’s spec sheet, however we do recommend collecting additional information from your users as deemed appropriate.

Transaction Limits

Appropriate transaction limits go a long way in mitigating risk. Transaction limits define the amount of funds that a user may move on a daily, monthly and annual basis. Daily limits helps us limit return risk while monthly and annual limits help us mitigate the risk of money laundering. Transaction limits are defined in collaboration with your Account Manager; tiered systems can be implemented where specific types of users might require different transaction limits. Platforms should consider what will be expected activity for their user base and apply reasonable limits in response.

We recommend setting lower transaction limits to new users and to require additional KYC documentation for users in instances where higher transaction limits are needed for the user case.

Get Notified of Any Returns Via Webhooks

Subscribing to TRAN|PATCH webhooks will help the platform remain aware of returns/chargebacks. This allows for proactive action, for example a platform that built logic on our webhooks might be able to identify users generating an exceptionally high level of chargebacks, and might decide to mitigate financial loss by reducing their limits or deactivating certain payment permissions.

Provide Accurate IP Address of The User on API Call Headers

Providing an accurate IP address of the user helps us and platforms combat fraud, and can serve as evidence for disputing transaction. Occasionally, certain platforms will submit their own IP on the API call header, we recommend not do so for the above-described reasons.

Accessible Customer Service

We have found that having accessible and effective customer service reduces risk. This makes it easier for users to communicate issues they might have with transactions to the platform before they request a return. We recommend for platforms to have:

- Phone & email address customer service.

- Trained customer support

- A detailed and relevant FAQs page.

Clear UI/UX

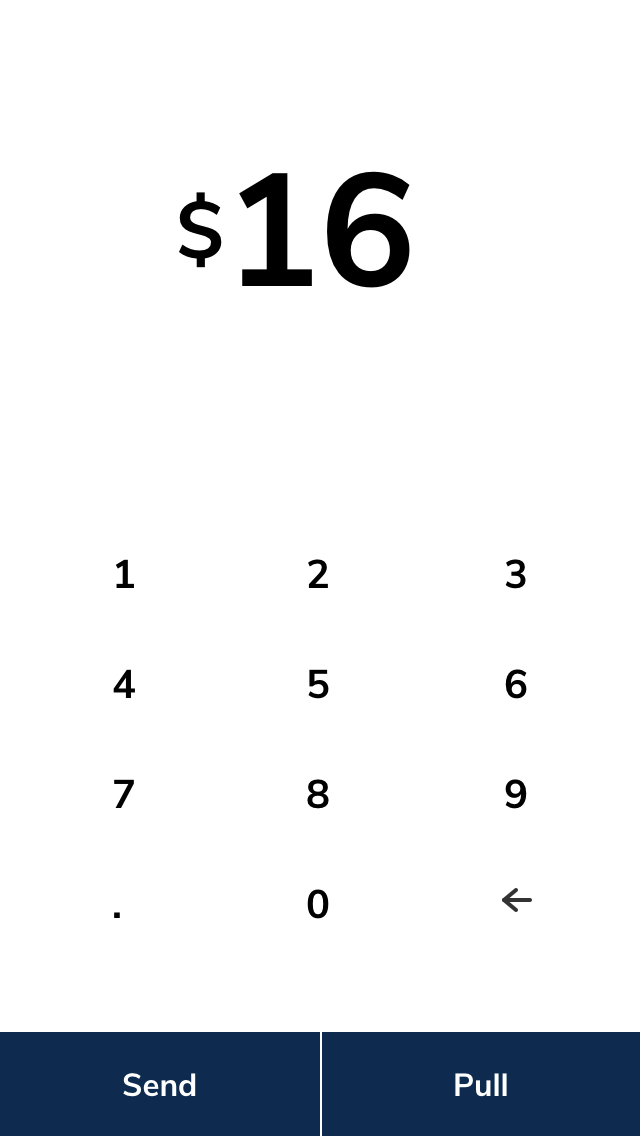

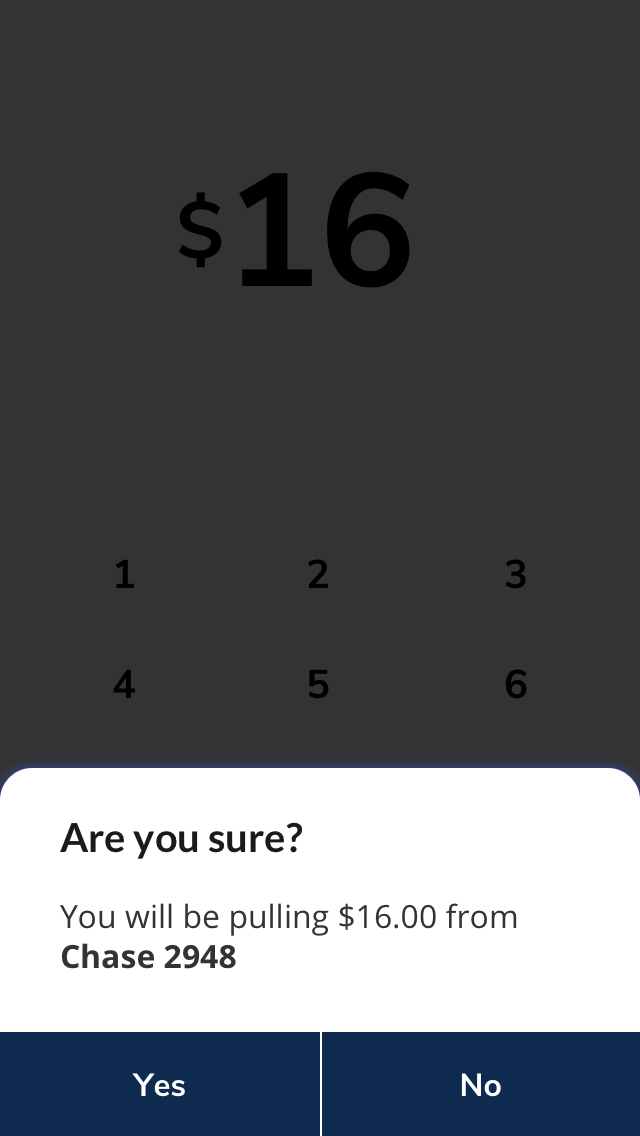

Interestingly, we have noticed that a clear UI/UX helps reduce some types of risk such as unauthorized returns. One of our platforms, for example, had a “pull funds” button in an area of the UI and had no “are you sure?” checks, this made it very easy for users to mistakenly press the button, which ultimately lead to a high level of ACH returns.

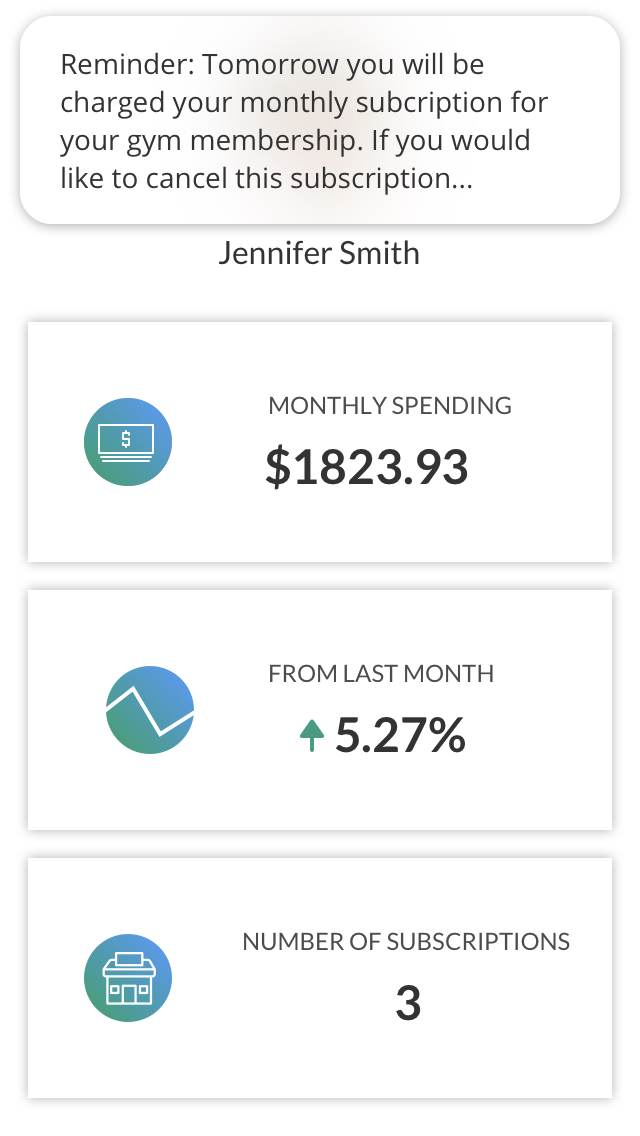

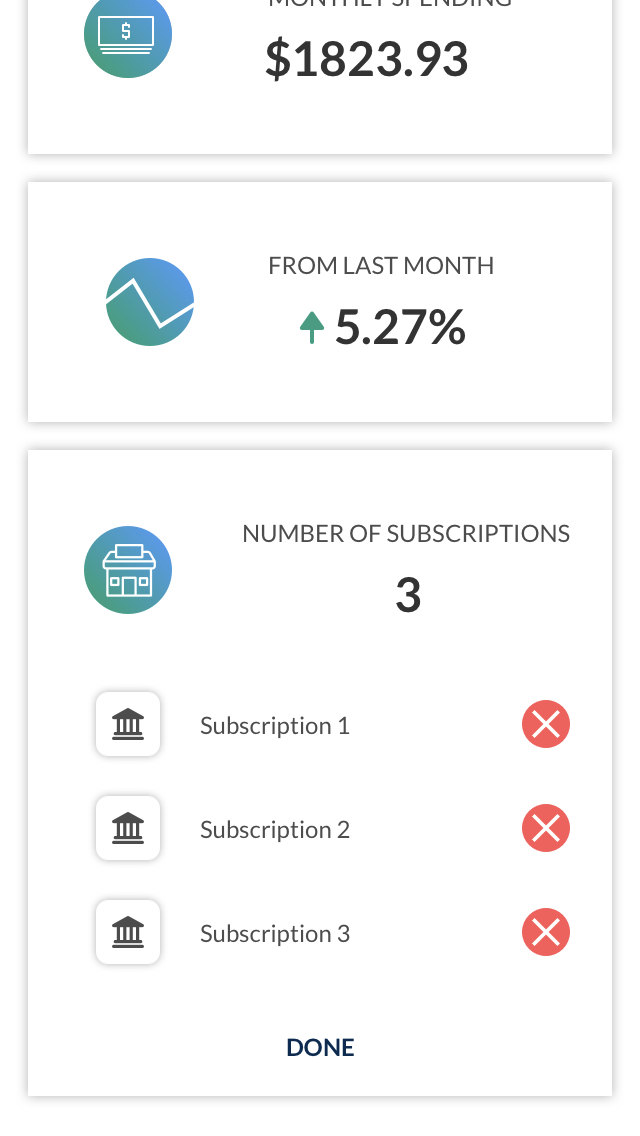

Below are some general UI/UX features we recommend Platforms should follow to avoid situations such as the one described above.

1. Have the “Pull Funds” button placed in area of the app that minimizes mistakes.

2. Have “Are you sure?” checks.

3. Have notifications & reminders about transactions (especially on recurring payments).

4. Build a user-friendly UI to cancel subscriptions.

5. Log-Off users from your website/app after a short period of inactivity

Updated over 5 years ago